If you pay dues to a professional union, you might wonder if they’re tax-deductible. If you’re a freelancer, the answer is likely yes — with some exceptions.

Who can deduct union dues?

Self-employed people, including freelancers and business owners, can deduct some union dues. If that’s you, you can skip ahead to read about the types of dues you can write off on your taxes.

This deduction exists to offer tax relief to people who have to pay union dues to run their businesses — and to motivate workers to participate in collective bargaining.

For W-2 employees, however, dues are less likely to be deductible.

Why most employees can’t deduct union dues anymore

In general, “union dues are not deductible for employees on a federal return,” said Thomas PM Perry, a Texas-based CPA. However, they “remain deductible… for employees located in certain states at the state level.”

This wasn’t always the case. Historically, union dues were treated as "employee business expenses" in the tax world. These were expenses paid by W-2 employees while performing their jobs, and they could be written off at tax time.

The Tax Cuts and Jobs Act (TCJA) of 2017 put a stop to that. Thanks to this law, W-2 employees can no longer deduct their business expenses for the tax years 2018 to 2025 — including union dues.

However, there are a few exceptions.

When can employees still deduct their union dues?

There are two possible exceptions, one that covers current union dues and one that only applies to dues paid in the past.

Situation #1: When your profession still allows employee business expense deductions

Some full-time professions still allow you to write off unreimbursed employee expenses — like union dues — as a W-2 employee. These include:

- Armed Forces reservist

- Qualified performing artist

- Fee-basis state or local government official

If this applies to you, you’ll use Form 2106, “Employee Business Expenses,” to write off your dues.

Situation #2: When you paid union dues before the TCJA and never wrote them off

If you paid union dues before 2018 and aren’t a statutory employee, you can still write off them off by:

- Amending your tax return (if you failed to claim them originally)

- Filing back taxes (if you never filed in the first place)

A statutory employee is an independent contractor who’s only treated as an employee for tax purposes.

Your pre-2018 union dues “can be generally deducted under ‘Miscellaneous deductions’ [on] your Schedule A,” said Ram R. Swamy, a Bay Area-based CPA. Be sure to use the form for the year you’re filing for.

Note: Miscellaneous deductions count as itemized deductions, so claiming them means you can't take the standard deduction that year.

What kind of union dues are tax-deductible?

Even if you’re a freelancer, your union dues only count as a tax deduction if:

- ✓ The union is an accredited trade organization

- ✓ The dues are directly related to your business activities

- ✓ The union dues count as an “ordinary and necessary” business expense — meaning, they’re expected in your industry and helpful for running your business

Here are some examples of people who would be able to write off their union dues:

- A freelance graphic designer who pays dues to the Graphic Artists Guild (GAG). Their GAG membership is directly related to their profession

- An independent actor on a contract that requires them to be in SAG-AFTRA. Your membership is a condition of working that job, so it’s definitely ordinary and necessary

- A self-employed author who pays dues to the National Writers Union. The NWU provides legal support whenever a publisher fails to pay them and helps them negotiate contracts. These benefits are considered ordinary and necessary for a writer, so the union dues are tax-deductible

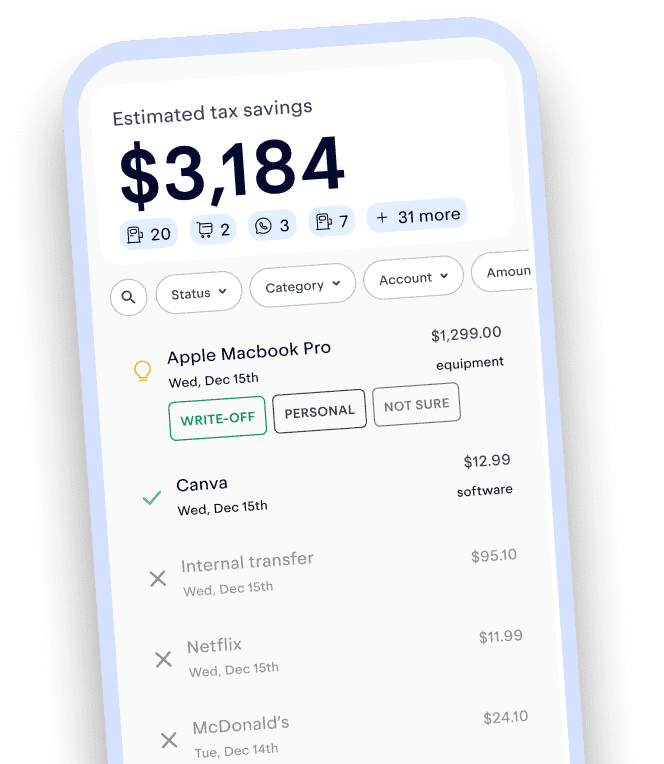

Figuring out if you can deduct your dues is just the beginning. To actually write them off, you’ll have to keep track of all the payments you make to maintain your union membership. That’s where Keeper comes in.

{upsell_block}

Whether you pay monthly or quarterly, our app will automatically log your union dues to simplify your recordkeeping and save you money at tax time. We’ll keep up with all your expenses throughout the year and automatically separate out the work-related ones — from membership fees to your work supplies to part of your Wi-Fi bill if you work from home.

You can file your taxes right in the app or download a nicely organized spreadsheet to pass on to your accountant.

What kind of union dues are not deductible?

Some union dues aren’t tax-deductible even for independent contractors. These include dues that were:

- ✘ Waived

- ✘ Covered by a client or employer

- ✘ For benefits that are mostly recreational or social, like a country club

- ✘ Paid to an organization not directly related to your trade or profession

For example, a freelance journalist who pays dues to a union representing construction workers can’t write those dues off — even if did it to find sources for an article on construction worker safety.

Now, what if the same writer also worked part-time as a construction contractor? In this case, dues to a construction workers’ union would count as a necessary expense for their second job, so they’d be able to write it off.

{email_capture}

How to write off your union dues

You can write off your union dues on Schedule C, alongside any other work-related expenses for your freelance job.

How to write off union dues for multiple professions

You’ll need to fill out a separate Schedule C for each of the freelance jobs you work. So if you’re a member of multiple unions in various fields, you may have to split your dues across several Schedule Cs.

Take our earlier example, of the freelance writer who also does contract work in construction. They might fill out:

- One Schedule C for writing, which includes dues paid to the Editorial Freelancers Association (EFA) — plus expenses like books, conferences, and transcription software

- A second Schedule C for construction, which includes dues paid to the International Union of Bricklayers and Allied Craftworkers (BAC) — plus expenses like safety gear, work tools, and contractor licensing

{write_off_block}

Where to write off your union dues

There are a few places on Schedule C where you can report them:

- Line 17, under "Legal and professional services"

- Line 8, under “Advertising,” if you paid for membership specifically to get more customers and grow your business. Note that you can’t do this if those membership dues can be considered a charitable contribution (that is, if your union is a nonprofit or does charity work)

- Line 27a and Part V of your Schedule C, under "Other Expenses" — Part V lets you fill in extra details about the amounts you put in 27a

However you plan to write off your union dues, keep careful records of what you paid during the year — whether that’s an emailed payment confirmation, a physical receipt, or an entry in the Keeper app.

If all these rules are making your eyes glaze over, you’re not alone! Thanks to constant changes in the law, it’s not always easy to figure out when your union dues and business expenses can actually be deducted. If you have any questions, feel free to contact us at support@keepertax.com, or download the app to message a tax assistant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email support@keepertax.com with your questions.