The subscription model is everywhere these days. From entertainment to food to clothes, you can pay a monthly fee for just about anything.

Many self-employed people rely on subscriptions every day for work. Whether it’s a blogger who pays a monthly web hosting fee, or a yoga teacher using Spotify to play soothing playlists for their classes, subscriptions can be a big part of running — or improving — your own business.

Freelancers, gig workers, and small business owners who use subscriptions for work might find themselves wondering, do the costs count as a deductible business expense?

We’ve got the answers!

Are subscriptions tax-deductible?

Yes, some subscriptions can be partially deducted from a self-employed person’s taxes. (More on how much in a little bit!)

But don’t go rushing to subscribe to every streaming service or monthly delivery box you can find. There are rules about the types of subscriptions you’re allowed to write off your taxes.

{write_off_block}

Subscriptions have to be ordinary and necessary

Here’s how the IRS puts it: “To be deductible, a business expense must be both ordinary and necessary.”

Not sure whether a subscription counts as a tax write-off, ask yourself the following:

- Is it ordinary? Is this subscription something that would be considered common in your line of work?

- Is it necessary? Do you need this subscription to do your job or to improve your work-related skills?

This sounds pretty clear. But the IRS’s definition of “necessary” has more wiggle room in it than you’d think.

“Necessary” doesn’t mean indispensable

The IRS notes that an expense doesn’t have to be indispensable to be considered necessary. It just has to be “helpful and appropriate.”

For example, you don’t need a subscription to National Geographic to run a hair salon. But offering people magazines while they wait for their haircut helps provide a positive customer experience. So you’d get to write it off.

What kinds of subscriptions can you write off your taxes?

The IRS doesn’t have a cut-and-dry list of subscriptions that count as business expenses. So to give you a better idea of what ordinary and necessary can look like, let’s cover six common types of subscriptions. We’ll also go over examples of who would — and wouldn’t — be able to claim the subscription as a tax deduction.

Keep in mind: These examples are far from exhaustive. There are many other jobs and situations where the following subscriptions would be write-off-eligible. Find out more on the IRS website.

1. Audio streaming services

✓ Deductible: An Uber driver who uses Spotify to entertain passengers.

✘ Not deductible: An independent bakery owner who listens to podcasts on Spotify while making bread. (Note: If they use Spotify to play music for customers during the bakery’s open hours, however, this would count as a business expense.)

2. Video streaming services

✓ Deductible: A pediatrician with their own practice who streams Netflix children’s programming in the waiting room to keep kids entertained while they wait for their appointment.

✘ Not deductible: A freelance web designer who uses Netflix to watch Gilmore Girls reruns during their lunch break. (Though some would argue this is indeed necessary, it’s definitely not necessary in the IRS’s sense!)

3. Newspaper and magazine subscriptions

✓ Deductible: A freelance columnist who subscribes to The New York Times because they need to stay on top of daily news coverage.

✘ Not deductible: A Lyft driver who reads newspapers or magazines while waiting for their next trip request.

4. Educational subscriptions

✓ Deductible: A marketing consultant who subscribes to a paid newsletter offering lessons on the latest SEO trends. Learn more in our article on tax-deductible education expenses!

✘ Not deductible: An Amazon Flex delivery driver who subscribes to a digital business course because they want to start their own consulting business.

What’s the difference here? According to the IRS’s rules, you can only write off work-related education if it’s something that helps you level up at your current job. Something that helps you pivot into a new line of work wouldn’t be tax-deductible!

5. Software subscriptions

✓ Deductible: A freelance graphic designer who pays monthly Adobe Photoshop fees.

✘ Not deductible: A freelance copywriter who pays monthly Adobe Photoshop fees to touch up personal photos before posting them to Instagram.

6. Professional membership fees and dues

✓ Deductible: A self-employed lawyer who pays bar association fees.

✘ Not deductible: A self-employed professional who pays fees for recreational clubs — such as a country club or fitness membership.

How much of a subscription can you write off?

You’re only allowed to write off a percentage of a subscription based on how much you use it for work. That means many subscriptions are only partially tax-deductible. After all, there's a natural business and personal use for lots of them. (In that sense, they're pretty similar to most home office expenses.)

Some examples for partial business use for a subscription:

- 🧘 A yoga teacher who uses Spotify during class also puts on playlists during dinner parties

- 🎬 An actor who gets Hulu to study up for an audition also catches a few reruns just for fun

- 📚 A Patreon romance reviewer who finds material on Kindle Unlimited also reads true crime without reviewing it

Because of situations like this, the IRS only lets you deduct the “business-use percentage” of your subscription. This might sound complicated, but it’s actually straightforward to figure out.

{email_capture}

How to determine the business-use percentage of a subscription

- Determine the total number of hours (or days) you use the subscription for work per year

- Divide that by the number of hours or day in a year

- Multiply the result by 100

Voila! That’s the amount you’re allowed to claim.

The business-use percentage calculation in action

Here’s an example: Let’s say a contract babysitter uses their personal Netflix to let the kids watch cartoons. The babysitter has five shifts a week (so 260 shifts per year) and allows the kids they watch 30 minutes of TV per shift. According to their Netflix watch history, they — and the kids — watched Netflix for a total of 730 hours that year.

Here’s what their write-off percentage might look like:

So the nanny can write off 17% of her Netflix subscription, because that’s the portion of it she uses for business.

Of course, video and music streaming services have business and personal uses. But that’s not true of all subscriptions.

What if you only use your subscription for work?

If you only use a subscription for work, you can write off 100% of the costs. Examples might include:

- 🛢️ An oil contractor who gets Pipeline & Gas Journal

- ⚖️ An attorney who subscribes to a legal database like Westlaw

- 🖥️ A freelance web developer who pays for LeetCode Premium to keep their skills sharp

Bottom line: If you don’t use it on your own time, feel free to take the full deduction.

How to track your subscription expenses

The top tip for making sure you’re able to write off your business expenses: be proactive about tracking them.

You don’t want to have to dig through a year’s worth of bank statements when it’s time to file. Wait till the last minute and you could wind up missing out on eligible write-offs.

Here are a few ways to stay on top of your subscription costs.

Use an app to track your expenses

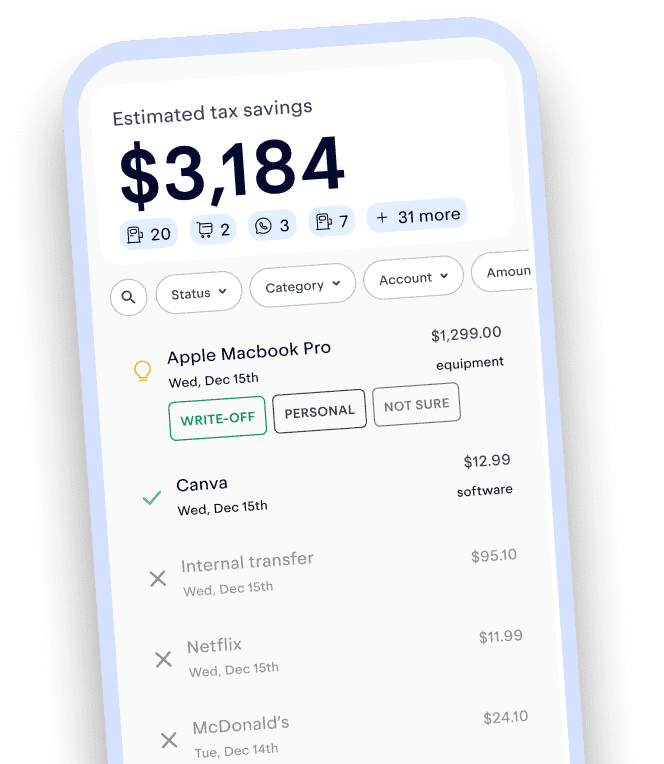

If you haven’t been tracking your small business tax deductions, don’t worry! Keeper will find them for you.

The Keeper app comes with a built-in deduction tracker that automatically finds qualifying business expenses — even purchases from months ago. Sign up for an account, and we’ll automatically scan your purchases for write-offs like subscriptions.

{upsell_block}

The app also stores your financial records for you, so you don’t need to worry about hanging on to receipts.

Use a business bank account

Keeping your personal and business expenses neatly separated can make it simpler to find and claim your deductions. Opening a business bank account means you’ll only have one set of bank statements to dig through.

Keep your own spreadsheets

While a tax app will log expenses for you, some people prefer the manual method. If that sounds like you, keep a detailed and frequently updated list of your subscription costs.

Here’s some information you might want to note about your subscriptions:

- Payment date

- Cost

- Payment method

- Vendor

- Category

- Percentage used for work

- Extra details, like the specific purpose of the subscription

You could also include your subscription costs in an all-in-one spreadsheet for independent contractor expenses.

How to deduct subscription costs on your tax return

Before you get started, double-check how often you should be filing your taxes with our free quarterly tax calculator.

Once you’ve got your tax schedule sorted, here are the steps to writing off subscription costs on your tax return.

1. Make a list of your expenses (and how much you can write off)

Good news: You’ve already done this part!

2. Fill out your Schedule C

Schedule C is the tax form you use to list your business expenses — including subscriptions! — and to determine your taxable income. You’ll include your subscriptions in box 27a, for “Other expenses.”

For a full breakdown of how this form works, check out our guide to filling out your Schedule C.

There you have it! As long as there’s a clear reason your subscription is directly related to the health and success of your business, there’s a good chance it’s at least partially tax-deductible.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email support@keepertax.com with your questions.