Are you spending money to advance your skills or keep up with your field? Good news: That could be a deduction.

Rules for claiming education expenses

Here are the IRS’s guidelines for tax-deductible education expenses.

✓ It allows you to maintain or improve your job skills

Over time, there are updates to the tools, software, and processes you use to do your work. To stay competitive, you need to maintain your level of skill -- and improve on what you already offer.

Training that helps you do this is tax-deductible. That goes for classes and self-study programs.

For example, say you pay for a class that walks you through massive updates to the software you use to provide design services. That counts as maintaining your skills.

Another example: if you take a class for a new program you want to start using for your design work, that counts as improving your skills.

Either way, the IRS will recognize your class as a deductible business expense.

✓ It's required by law to maintain your status

Some professions are required by law to complete continuing education.

For example, a real estate agent in California needs to complete multiple hours of continuing education between license renewal periods. Not meeting this requirement may mean you won’t be able to work.

Since this is required by law, the IRS will allow it as a deduction.

✓ It's related to your current business

The education you’re paying for has to be directly related to the work you’re doing now. It can't qualify you for a new line of work.

A delivery driver, for instance, can’t deduct a class on investigative journalism. But a reporter can.

This rule can be tricky. Say you're a freelance web developer, and you want to take a sales class so you can better sell your services. Even if you have no intention of becoming a salesperson, the IRS may disallow this deduction.

Why? Because your new sales skills could qualify you for a new business, even if that wasn't your intention.

✘ It isn't to "establish" a new business

Speaking of which, the IRS doesn’t allow deductions for educational expenses that help you meet the “minimum requirements” to offer services in a new field.

A DoorDasher wouldn’t be able to write off drivers ed. And someone who wants to be a software engineer can’t write off their first coding course.

What education expenses are tax-deductible?

We’ve been talking mostly about classes. But other types of expenses can qualify too. Here are the basic categories you should look out for:

- 📖 Course-related books, supplies, and transportation

- 💳 License renewal fees

- 📰 Industry magazine subscriptions

- 🎧 Podcast subscriptions

{upsell_block}

Now, let's go over some examples of tax-deductible educational expenses.

School tuition

If you are working toward a part-time degree while freelancing, then you might be able to claim your tuition (and other associated fees.) For example, you might be a freelance consultant going to college on the side.

Just remember: To claim your tuition, you have to already be freelancing in a field related to your degree.

Here is our guide to carrying losses forward for educational expenses on your income tax.

Online web development course

Let’s say you’re a freelance designer who creates branding and marketing assets for small businesses. You start a Coursera course so you can add web design to your roster of services.

That’s considered work-related education, and it's tax-deductible.

{email_capture}

Real estate license renewal

Some industries — like real estate — require licenses or certifications to be periodically renewed. All those fees are tax-deductible.

Just remember: You have to be working in that field right now. The costs associated with getting your real estate license the first time around can’t be written off.

Wall Street Journal subscription

A news subscription can be an effective way to stay up to date with your industry. If it helps you with client small talk and ensures that you sound professional at meetings and conferences, it’s a write-off!

Improv class

If you do a lot of public speaking over the course of your freelance work, an improv class can help you loosen up and feel more comfortable on the job. That means you can deduct the class from your tax bill.

{write_off_block}

Another tax break for your educational expenses

You can't always claim your education expenses as a business deduction. But there's another tax break you might be able to claim.

Enter the Lifetime Learning Credit. You can use it to pay for courses at a college, university, or trade school.

The Lifetime Learning Credit is worth up to $2,000 per tax return. It comes with a gross income limit of $69,000 (or $138,000, if you file jointly).

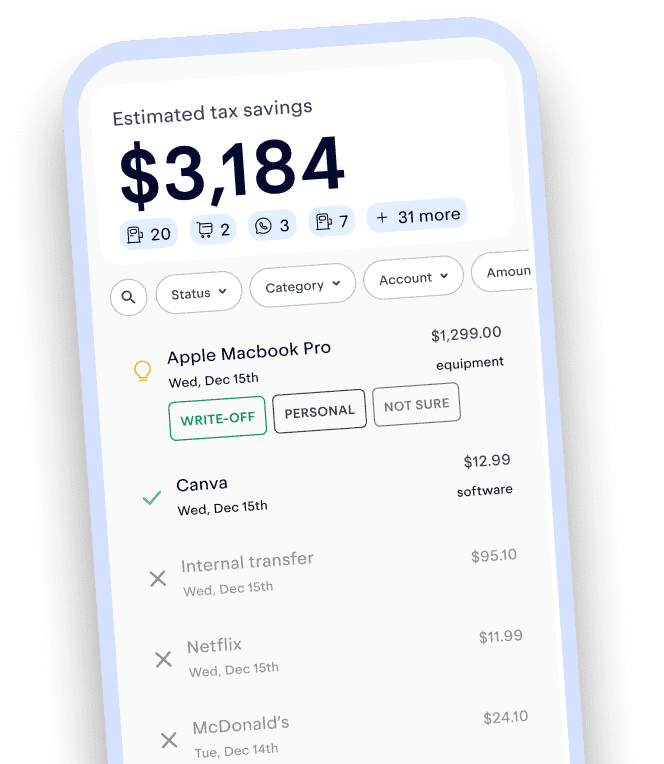

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email support@keepertax.com with your questions.