If your freelancing, 1099 contracting, or small business involves driving, then you can claim car-related tax write-offs.

Owning a car isn’t cheap, so this move can provide a significant source of tax deductions. Let’s dive (drive?) in!

Who can deduct car expenses?

You don’t have to be a rideshare driver or a self-employed traveling salesperson to claim car-related tax deductions. Even if you work primarily from a home office, the occasional supply run or client meeting downtown counts.

You also don’t need to drive year-round. If you only drive for work during the summer, you can still write off car expenses during those months.

"Commuting" doesn't count

According to the IRS, "commuting" doesn't count as driving for work.

What does that mean? For the IRS, "commuting" is any driving you do between your home and a separate, dedicated place of work — like an office or a coworking space.

If you have a tax-deductible home office, however, any driving to and from work-related meetings and errands counts!

How to write off car expenses

There are two ways to claim car-related write-offs: keeping a mileage log, or (more easily, in our opinion) claiming a percentage of all your car expenses.

Standard mileage method

With this method, you keep track of how many miles you actually drive for work. Then, you multiply each mile by a standard amount set by the IRS.

The rate changes every year. For 2023, it's $0.655. In 2024, it's set to increase to $0.67.

The IRS introduced this option In the late '90s. At the time, it was intended to simplify the recordkeeping process of tracking car expenses. In those days, after all, you'd have to go through the hassle of using something like a 1099 Excel template to track everything you spent on your car.

These days, though, modern apps (like Keeper!) allow you to scan and categorize your credit card transactions automatically. That makes the actual expenses method a lot more convenient to use.

Actual expenses method

Instead of claiming deductions based on the miles you drive, you can just deduct a percentage of all your car-related expenses. This is called your “business-use percentage” — that is, how much of your driving you do for work. You'll still need to keep notes supporting the percentage, so many people use mileage trackers even when using the actual expense method.

What's better: Standard mileage or actual expenses?

Honestly, it depends on your particular situation.

Generally speaking, unless you’re a voracious driver or have a very old car, claiming actual often results in a bigger tax break.

However, there are some situations where the standard mileage method might actually be better for you:

- You drive a lot for work — over 30,000 miles per year. If your work is something that requires you to be constantly on the road, like rideshare driving, then tracking mileage might get you a bigger tax deduction. (Uber and Lyft track some miles for you, but generally not all of them.) You might also drive a lot if you live and work in a rural area, and your worksites are further apart than people typically see in the city

- You drive an electric vehicle. Since you don’t spend money on gas with an electric car, it’s likely that the mileage deduction will get you a bigger tax break. That said, most electric cars are expensive to buy, insure, and maintain. So car expenses might still win.

The actual math is complicated, and it depends on lots of different factors. Check out our detailed breakdown for more examples.

Which car-related expenses can I write off?

There are two types of car expense write-offs: expenses you can only deduct with the actual expense method, and expenses you can deduct with both methods.

{upsell_block}

What you can write off with the actual expenses method

These expenses replace the mileage-based deduction you take with the standard mileage method.

- ⛽ Gas

- ☂️ Insurance

- 💰 Lease payments

- 🔧 Maintenance

- 🏷️ Cost of the car

If you finance your car, then you can write off your own car payments. (This is called “depreciation.") Even if you bought it a few years ago, you can even write off a portion of the car's original cost.

{write_off_block}

What you can write off with both methods

Even if you go with the standard mileage method, you can claim these deductions on top.

- 🅿️ Parking

- 🛂 Tolls

- 🧽 Car washes

- 🪪 DMV fees

Here's a chart summarizing the two types of vehicle expenses.

Calculating your business-use percentage

If you go for the actual expenses method, you’ll have to determine your business-use percentage. To figure this out, you need to estimate how much of your driving mileage is “driving for work,” as opposed to personal errands and commuting. Don’t worry -- it’s not an exact science.

For example, if you typically drop off your kids at school in the morning and then use the car for work errands and meetings throughout the day, then your business-use percentage might be 75%.

Just like the mileage deduction, be sure to keep notes and records supporting your claim. Many people keep a mileage log regardless of which method they choose.

{email_capture}

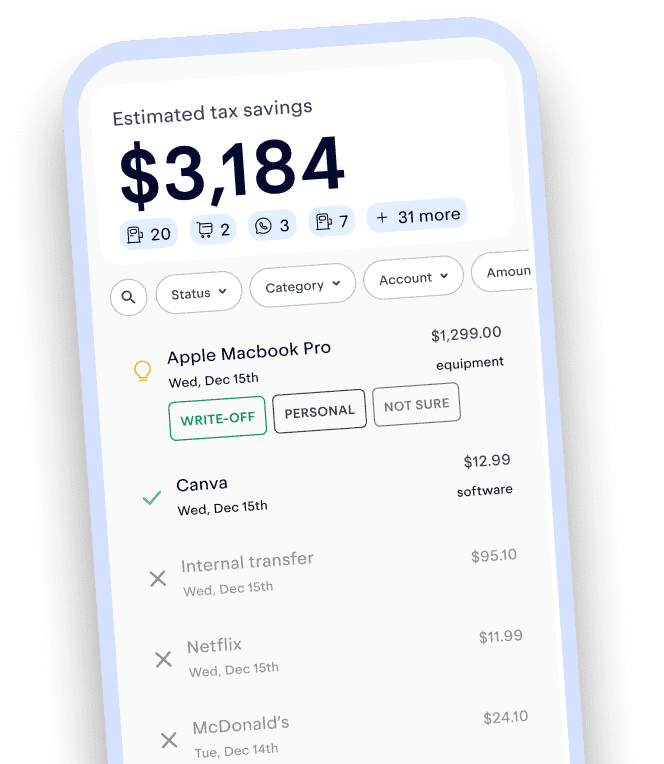

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email support@keepertax.com with your questions.