We’ve all had the experience of signing up for a gym membership, only to use it twice and forget about it. After eight months of payments and a brief period of self-loathing, there are really only three options left:

One: Go to the gym? (Nah….) Two: Cancel your membership? (And admit defeat? Never!) Three: Ask Keeper if the membership can lower your tax bill? (Ding! Ding! Ding!)

Can you deduct your gym membership as a business expense?

So here we are: the last-ditch effort to salvage your gym bill. Sadly (much like your New Year's goals) be prepared for disappointment. Gym memberships are generally not tax-deductible. Consider them a personal expense.

As with all rules, however, there are a few exceptions. Many freelancers, small business owners, and self-employed people work in fields that require them to stay in shape. So if a reasonable case can be made that the gym is ordinary and necessary to your trade or business, you can deduct it.

Understanding "ordinary and necessary" expenses

Most of us don’t describe our business expenses in terms of “ordinary” or “necessary.” So what does that mean?

- Ordinary: Put simply, an ordinary expense is one that’s common in your field. For instance, vocal coaches regularly purchase sheet music. Sheet music isn’t a typical business expense in most industries, but it’s an obvious cost for music teachers. It’s obvious because it’s ordinary.

- Necessary: Necessary just means essential to running your business. If we return to the example of vocal coaches, not only is sheet music a common purchase, it’s also an essential one. They need to have a selection of music to accommodate the range of students they work with.

If we return to the question of gym memberships, the only way it would qualify as a business expense is if it met both of the requirements listed above.

{email_capture}

When gym memberships might be tax-deductible

Unfortunately, that’s a difficult case to make for most freelancers. But since I promised exceptions, let’s take a look at the few jobs that might qualify.

For personal trainers

Trainers help people achieve their fitness goals, so a gym membership is a common expense for them to have. Since many trainers don’t own their own fitness facilities, they often require a gym to meet with clients.

For example, let’s say you meet with clients at the gym 10 times a week and exercise on your own five times a week. Then the business portion of your membership would be 66% (10 / 15 = 0.66), so you’d be able to write off 66% of your gym membership fees.

Alternatively, if you’re a trainer who operates your business out of a home gym, you’re eligible to take a home office deduction, as well as to deduct the full cost of equipment purchased for the business.

Can you deduct your gym membership as a medical expense?

There is a lot of misinformation out there about this, so I want to take a moment to set the record straight: gym memberships never qualify as a medical deduction.

The IRS allows people to include weight loss activities in their itemized medical expenses, if their physician prescribes it following a diagnosis like obesity, hypertension, or heart disease.

The code outlines “weight loss activities,” as participation in support groups and weight reduction classes. It also permits fees charged by your gym specifically for those activities. But it specifically prohibits gym memberships themselves.

Finding other tax write-offs

Even if you can’t write off your gym expenses, there are plenty of other creative write-offs to think about.

{upsell_block}

🎓 Continuing education

Classes or events to better your skills or expand your industry knowledge are fully tax-deductible. An example of this would be a yoga instructor taking a weekend retreat to further their craft.

💻 Equipment costs

Work computers, tablets, camera and audio equipment, printers — any equipment needed to successfully operate your business can be written off. If you play music in your spin class, write off the stereo!

{write_off_block}

💽 Software expenses

File-sharing software, CRM programs, bookkeeping tools like Keeper, and even the entire Office 365 package! If you use apps like Renpho to track your clients’ body composition stats, include those here as well.

📈 Marketing

This can include anything from website fees to professional headshots to sponsoring the local middle school soccer team! Any expenses used to promote your company or brand will count.

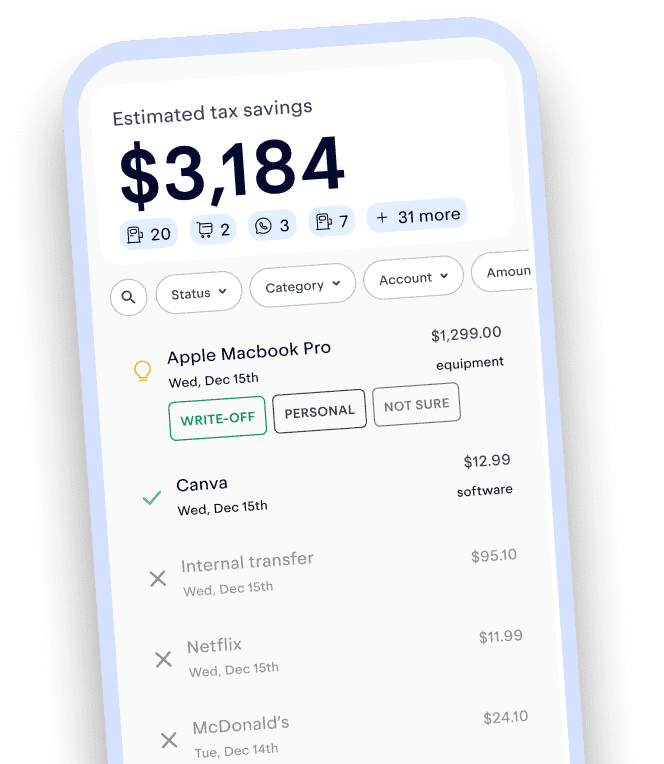

You can use Keeper to automatically scan your purchases for these and other deductions. Use it to keep track of your business expenses, and you can make sure you’re maximizing your savings during tax season!

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email support@keepertax.com with your questions.