What Expenses Can I Deduct on My Taxes as a 1099 Contractor?

A free tool by

If you're a freelancer, 1099 contractor, or small business owner, you get tax write-offs that W-2 employees can't claim. Tell us what you do for work, and we'll tell you what you can write off.

At Keeper, here’s one of the questions we get asked the most: “What expenses can I deduct as a freelancer?”

It’s a good question. Most self-employed workers don’t claim the write-offs they’re allowed to take. That means they end up overpaying the IRS, by about 21%.

That’s why we built this tool. Find your job in the dropdown above, and we’ll show you the write-offs you can claim at tax time.

The tax deductions you can take might depend on what you do for work. Some are super specific. For example:

- 🏋🏼♀️ A bodybuilder can write off the body oil they use in competitions

- 🐕 A junkyard owner can claim the cost of dog food, to feed the security dogs they bought to protect the premises

- 🤡 A rodeo clown can deduct their makeup and costumes

- 🤣 A Patreon comedian can deduct the comedy shows they go to for research

Other write-offs are common across all kinds of jobs.

Let’s go over the top 22 don’t-miss deductions. For each one, we'll tell you:

- Which taxes it'll help you save on

- Which form you'll use to claim it when you file your tax return

Don’t want to deal with the paperwork yourself? Then let us file your self-employment taxes for you.

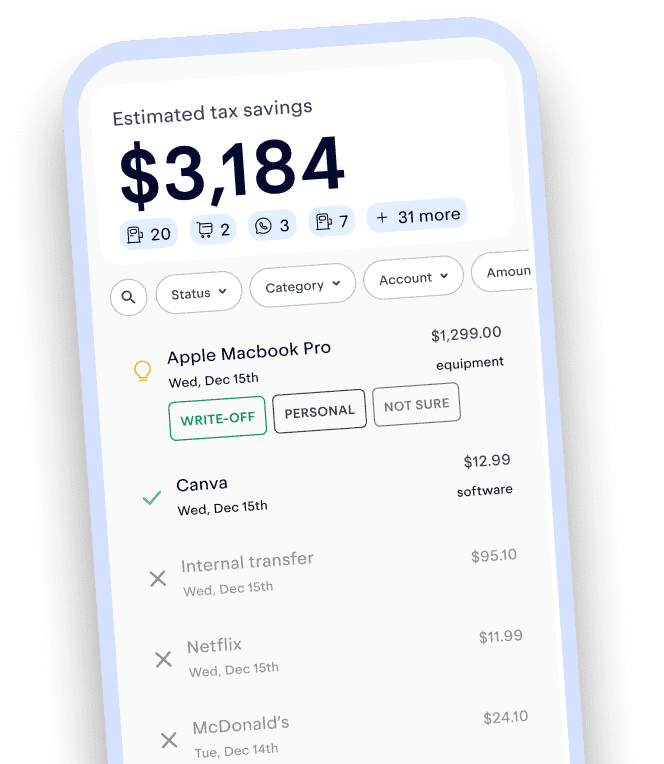

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

🚗 1. Car expenses

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 9 (“Car and truck expenses”) and Form 4562

If you ever drive for work, you can write off your car expenses.

How do you write off car expenses?

There are two ways to claim your car-related costs:

- The actual expense method

- The standard mileage method

You’ll have to pick one of them — you can’t use both.

See how the two methods compare in our guide to actual expenses vs. standard mileage. But for now, here's a quick breakdown.

Deducting car expenses using the actual expenses method

When you use this method, you'll be able to deduct part of what you actually spend on your car (depending on how much you're driving it for business rather than personal use). Think:

- 🛞 Tires

- ⛽ Gas

- ☔ Car insurance

- 🔧 Maintenance and repairs

- 📉 Vehicle depreciation

… and more!

The amount you can claim is based on how much you drive specifically for work, or your “business-use percentage.”

If your car use is 60% work-related, you’ll be able to write off 60% of what you’re spending on all the expenses above.

Deducting car expenses using the standard mileage method

When you use this method, you’ll:

- Track the number of miles you drove for business purposes

- Multiply that by a standard mileage rate provided by the IRS

The IRS’s standard mileage rate for cars, vans, pickups, and panel trucks for 2024 is 67 cents per mile driven for business purposes, up 1.5 cents from last year. This rate applies whether you’ve got a gasoline, diesel, hybrid, or electric vehicle.

What's the best way to write off your car expenses?

General rule of thumb:

- If you drive a moderate amount for work (<20,000 miles): Use actual expenses

- If you drive a lot for work (>20,000 miles): Use standard mileage

That’s how the math works out to give you the biggest savings.

🅿️ 2. Parking

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 27a (“Other expenses”)

You might think of parking as a car-related expense. But this write-off really belongs in its own category.

That’s because work-related parking fees are 100% tax-deductible. There’s no need to deal with a business-use percentage.

It’s pretty hard to park somewhere partially for work and partially not for work. (Even if you tack a personal errand on after your work stop, you can still write off the full amount.)

Can you write off parking fees if you get reimbursed?

No. If your client reimburses you, it isn’t a write-off. You can only claim your parking if you are the person footing the bill.

Are parking tickets tax-deductible?

Unfortunately, no. Parking tickets don't count as a write-off. So keep track of your meter time while you’re out on the job!

🏠 3. Home office expenses

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Line 30 and Form 8829

They say the home is where the heart is. But for lots of freelancers, home is also where the work is.

Enter the home office deduction: It’s a powerful tax break exclusively for the self-employed. And it lets you write off a chunk of your living expenses.

Who gets to claim a home office?

Self-employed people who WFH can take the home office deduction.

There has to be a space in your home that you use only for business. It could be:

- A small work area in the corner of your bedroom

- A storage zone for your online store

- A home gym where you see personal training clients

- An art or photography studio

Anything business-related is fair game.

There are some rules. To quickly figure out if you qualify, take our home office deduction quiz. (You’ll also find a full explanation of this tax break, including a breakdown of everything you can claim and a downloadable cheat sheet.)

What home expenses can you write off?

Here are some common expenses you can deduct:

- 🏠 Rent

- 🚰 Utilities

- 💰 Mortgage interest

- 💰 Home insurance

- ⚒️ Home improvements

- 🔒 Home security

- 🪑 Home office equipment and furniture

… and more!

🏢 4. Rent

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 20 (“Rent or lease”)

The home office deduction lets you write off part of your personal rent. If you’re a freelancer who rents a separate office or coworking space, that’s a write-off too.

Can you write off equipment rentals?

Yes, you can also deduct any rent you pay on business equipment. Here are some examples:

- 📸 A photographer renting a lighting rig

- 🏡 A landscaper renting a backhoe for a larger job

- 🎉 A caterer renting tables and chairs

💻 5. Laptops and gadgets

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 27a (“Other expenses”)

These days our lives are run on technology. (All hail our digital overlords!) For that reason, even the simplest freelance business will need things like:

- 💻 A laptop or desktop computer

- 📱 A cell phone or tablet

- 🖥️ Monitors

- ⌨️ Keyboards

- 🖱️ Computer mouses

Can you deduct the whole cost of a computer?

Only if you use it exclusively for work. This goes for other tech too: A work-only phone or monitor is 100% tax-deductible.

If you use a gadget for work and personal reasons, write off your business-use percentage.

What happens if you’re not sure how much you use an item for work?

If you’re unsure about your business-use percentage, you can:

- Guesstimate it

- Go slightly lower to be safe

So, if you think you’re at about 50%, make it 40% — just to stay on the safe side. The higher your business-use percentage, the more likely you are to set off red flags at the IRS.

📱 6. Internet and phone bills

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 27a (“Other expenses”)

Much like your tech hardware, you can deduct your internet and phone bills from your tax bill — but not entirely.

One exception: The phone bill for a dedicated work device is completely tax-deductible.

For the most part, though, you’re likely to use your Wi-Fi and phone service for both business and personal purposes. So go ahead and take your business-use percentage. Follow the same rule of thumb you’d use to estimate your business-use percentage for laptops and gadgets above.

📎 7. Supplies and tools

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 22 (“Supplies”)

As a 1099 contractor, you'll probably need some supplies and tools to run your business. Luckily, you can deduct the amount you spend on them each calendar year.

Some office supplies are common no matter what kind of work you do. Think:

- 🖊️ Pens

- 📝 Paper

- 📎 Paperclips

There are also industry-specific deductions:

- 🧰 If you are a kitchen remodeler, write off your hammer and oscillating multitool

- 🔪 If you’re a home chef, write off your kitchen knives

- 🪡 If you’re a style consultant, write off your clothes steamer and emergency sewing kit

Bottom line: If you use something to do your work, it’s deductible.

🍴 8. Business meals

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 24b (“Deductible meals”)

You can write off a meal — or even a quick coffee — as long as it’s work-related. Some examples:

- ✓ Catching up with a client

- ✓ Schmoozing a potential client

- ✓ Attending a sales pitch

- ✓ Meeting your mentor to talk shop

- ✓ Sharing info with someone you’re referring to your work platform

- ✓ Grabbing a meal while you’re on a business trip

What meals can’t you write off?

This write-off doesn’t apply if you’re setting up shop in a cafe, munching on bread bowls and bear claws while updating spreadsheets.

Rule of thumb: If you’re eating while working on a task you can do from home in your underwear, it’s probably not something the IRS will view as a justified business meal.

The exception: Eating on a business trip

The rule of thumb goes out the window if you’re on a legitimate business trip. (We’ll talk about how your travel expenses count in the next section!)

If you had to leave town for work, feel free to write off your overpriced airport burrito or the takeout you ordered to the hotel.

How much of a meal can you write off?

You can only deduct 50% of a business meal's cost. Food and beverages bought at restaurants were 100% deductible in 2021 and 2022. But for 2023 onwards, the rules have changed back to how they were defined in the Tax Cuts and Jobs Act — so your business meals aren’t 100% deductible anymore.

🛫 9. Travel expenses

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 24a (“Travel”)

If you travel for business, there are a whole lot of write-offs you can claim.

You might be getting tired of hearing this, but travel expenses have to be business-related and within the realm of reason. You can't expect to deduct expenses that are:

- ✘ For personal purposes

- ✘ Extraordinarily extravagant

Bottle service, we’re looking at you!

For more info on the rules, take a look at our guide to business travel deductions.

What travel-related expenses can you write off?

Here are write-offs you can claim:

- ✈️ Flight, train, or bus ride tickets

- 🚕 Taxi or Uber fare

- 🏨 Airbnb or hotel costs

- 🥡 Food while traveling

- 📱 Phone expenses (like roaming fees or an international SIM card)

- 👔 Laundry costs

📕 10. Educational expenses

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 27a (“Other expenses”)

It's crucial to invest in improving (or maintaining) your skills. That’s why the IRS lets self-employed people write off work-related education expenses.

What counts as an education expense?

Anything that helps you learn on the job counts as work-related education. You don’t need to get a degree or certificate.

Some examples include:

- 🏫 Classes

- 📖 Textbooks

- 📚 Regular books you use for work-related purposes

- 🖥️ Webinars

- 🤝 Conferences

What education expenses can’t you deduct?

Everything you write off has to be:

- ✓ Ordinary for your field

- ✓ Related to your current line of work

You can’t write off any training designed to prepare you for a different job.

If you're a writer, for example, you can't deduct weekly karate classes.

But if you’re a fiction writer, you can deduct short story collections — something an Uber driver wouldn’t be able to write off.

📰 11. Publications, subscriptions, and memberships

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 27a (“Other expenses”)

Tax-deductible subscriptions can overlap with education expenses. But so many freelancers miss out on this category, we thought it was worth calling out.

What kind of subscriptions can you write off?

If you subscribe to any kind of publication, platform, or software service for work, it’s a write-off! This is a pretty broad category. It can include:

- 📰 An trade magazine that help you stay up to date

- 📧 A paid listserv for freelance jobs in your industry

- 📱 A premium podcast from someone who’s made it to the top in your field

Professional membership fees and union dues are also deductible.

Depending on what you do for work, there might be some more specific subscriptions you can write off, like:

- 🎶 Spotify you play in the car for your passengers if you’re an Uber driver

- 📺 YouTube Premium for educational videos if you run a daycare

- 📼 Netflix for pre-audition research if you’re an actor

🏬 12. Advertising

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 27a (“Other expenses”)

All advertising costs are 100% tax-deductible. What’s more necessary to a business than promoting yourself, your services, and your products?

What counts as an advertising expense?

This deduction is a lot more flexible than most freelancers realize. Literal ads aren’t the only thing you can write off. Some other examples include:

- ✓ Printed flyers

- ✓ Business cards

- ✓ Pens, mugs, and other cheap items with your brand printed on them

- ✓ Google and Facebook ads

- ✓ A booth at a trade show

- ✓ Services from a PR agency

- ✓ A catered event for current and prospective clients

There are plenty of creative ways to get more customers. So feel free to think outside the box!

For more creative ideas — including donating to a charity in exchange for a shoutout — check out our detailed guide to advertising expenses.

👨💼13. Contract labor

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 11 (“Contract labor”)

It’s not unusual for freelancers to hire other freelancers. For instance, you might hire:

- ✍️ Copywriter

- 🖌️ Graphic designer

- ⌨️ WordPress developer

- 🎧 Virtual assistant

Go ahead and write off their fees!

Just remember: If you pay a contractor $600 or more over the course of the year, you'll have to file a 1099-NEC for them.

That’s unless you use a credit card or payment app like Venmo or PayPal. In that case, your payment processor will take care of issuing the a Form 1099-K, and you have nothing to worry about!

⚖️ 14. Professional and legal fees

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 17 (“Legal and professional services”)

Besides finding outside help to get the job done, business owners might hire a professional just to make sure their ducks are all in a row, legally speaking.

If your business ever needs you to hire a:

- 🤝 Consultant

- ⚖️ Lawyer

- 📁 Accountant

…go ahead and write them off!

These types of fees — especially legal fees — tend to be on the heavier side. That’s why no self-employed person should be leaving these write-offs on the table.

💼 15. Business insurance

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 15 (“Insurance”)

It costs money to protect yourself and your assets. Some businesses take on more risks than others. For those, insurance plans like:

- 🛡️ Liability insurance

- 🛡️ Material insurance

…offer a healthy peace of mind.

If that’s the case, your monthly premiums are 100% tax-deductible.

📉 16. Business loan interest

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 16b (“Interest: Other”)

If you took out a loan from a bank specifically for business purposes, the interest on that loan is a write-off. That includes:

- 🏦 Interest on a business loan

- 💳 Interest on a credit card you used for work-related purchases

Lots of freelancers rely on credit to maintain and grow their businesses — which can get expensive. It’s nice to put something back in your pocket at tax time.

👔 17. Business startup costs

Use it to lower: Your self-employment taxes

Where to claim it: Schedule C, Box 27a (“Other expenses”) and Form 4562

Sometimes, you need to spend money on your business before you’ve gotten a single client — or made a single dime. Good thing the IRS lets you write off these startup costs.

What kind of startup costs can you deduct?

Here are some common ones:

- 📊 Market research

- 🏬 Office or storefront rent

- 🛍️ Travel to find distributors and suppliers

- 🧾Fees to start an LLC

How much if your startup costs can you deduct?

The first year you’re in business, you can deduct up to $5,000 of these startup costs in one lump sum.

What if you spend more than $5,000 getting started?

Don’t worry: You can write off the rest of your startup costs by amortizing them — basically, spreading them out over several years. Our guide on startup costs will tell you how this works.

The write-offs above all go on your Schedule C and lower your self-employment tax. Self-employed people can also claim other tax breaks that work a little differently — they’ll lower your income taxes instead.

These types of tax breaks can be powerful financial tools for freelancers. Let’s dive into them — starting with the most confusing one.

📊 18. Self-employment tax payments

Use it to lower: Your income taxes

Where to claim it: Schedule SE, Line 13 (“Deduction for one-half of self-employment tax”)

Did you know you can use your self-employment tax bill to lower your overall tax bill?

In the words of everyone’s favorite entrepreneurial raccoon: Yes, yes, it’s true! When it’s time to file income taxes, you can deduct half of the self-employment tax you’re paying.

This deduction is a little hard to wrap your head around — especially for new freelancers.

Let’s go over how it works.

Why do freelancers pay an extra self-employment tax?

Self-employment tax is how freelancers and gig workers pay their share of Medicare and Social Security taxes — also known as FICA taxes.

W-2 workers also pay FICA taxes, to the tune of 7.65%. Their employers pay another 7.65% on their behalf.

If you’re self-employed, though, your employer is… well, you. So you’re responsible for paying both halves of your FICA taxes, for a total rate of 15.3%. (This doubled FICA tax rate is what we’re referring to when we talk about “self-employment tax.”)

Why is half of your self-employment tax deductible?

You have to pay twice the FICA taxes to be your own boss. It’s only fair that the IRS lets you deduct the “employer” portion when you file income taxes!

Finding out how much self-employment tax you can deduct

Want to see how much that deduction comes out to? You can find out in just two steps:

- Use our handy self-employment tax calculator to estimate how much you’ll pay

- Divide that number by two

That’s the amount you can deduct when you pay income taxes!

💰 19. Qualified business income

Use it to lower: Your income taxes

Where to claim it: Form 8995

Introduced in 2018, the Qualified Business Income (QBI) deduction lets self-employed people write off up to 20% of their taxes.

All you need to do to claim it is to fill out Form 8995 (or, if your income is really high, Form 8995-A.) Our post on the QBI deduction explains everything you need to know!

🩺 20. Health insurance

Use it to lower: Your income taxes

Where to claim it: Schedule 1, Line 17 (“Self-employed health insurance deduction”)

Healthcare costs are high enough to make anybody sick. You know it’s bad when even the IRS is sympathetic.

Because self-employed people don’t get the benefit of an employer-sponsored plan, they get to deduct health insurance premiums for themselves and their family, including:

- 😷 Medical insurance

- 🦷 Dental insurance

- 👁️ Vision insurance

- 👴 Long-term care insurance

Learn more about how this works in our guide to the self-employed health insurance deduction.

👵 21. Retirement contributions

Use it to lower: Your income taxes

Where to claim it: Schedule 1, Line 16 (“Self-employed SEP, SIMPLE, and qualified plans”)

If you want to lower your tax bill now and prepare for the future, you can deduct the money you’re saving for retirement.

There are several types of retirement plans for freelancers, including:

- SEP IRAs

- SIMPLE IRAs

- Solo 401(k)s

If you’re making enough from freelance work to set some money aside, do it. Your future self will thank you — not just years from now, when you’re looking to retire, but months from now, when you have to file taxes.

📉 22. Business losses

Use it to lower: Your income taxes and (future) self-employment taxes

Where to claim it: Schedule 1, Line 8a (“Net operating loss”) and Form 461

Sometimes, businesses lose money. The IRS gets it. That’s why you can deduct your business losses.

You can learn more in our deep dive into business loss deductions. But here’s the info in a nutshell.

How do business loss deductions work?

Say you lose money on your 1099 work while you’re also working a W-2 job. You can use your business loss to offset your W-2 income, lowering the amount you’ll be taxed on.

Lowering your income taxes

Here’s an example. Pretend you:

- Had a loss of $3,000 on your side hustle

- Earn $45,000 at your day job

You’ll subtract your $3,000 loss from your $45,000 income. So you’ll only pay income taxes on the $42,000.

Lowering your self-employment taxes

You can also use your business losses to lower the self-employment taxes you pay in a future year, when you start earning money.

Losing money is completely normal – especially when you’re first starting out. You can use those losses to save on your taxes once you do make a profit.

Now you know the top write-offs for self-employed people. In case you're still not sure what counts, let’s cover a few more frequently asked questions.

FAQ

- What counts as a business expense?

- Can you write off expenses if you get a 1099?

- Do you need a receipt to claim a write-off?

- What is the maximum deduction self-employed people can take?

What counts as a business expense?

All sorts of things! To write it off on your taxes, an expense has to be both:

- ✓ Ordinary: Typical of your industry

- ✓ Necessary: Helpful for doing your job

There are a lot of creative business expenses that get overlooked or ignored because they seem too “weird.” Don’t let that be you!

When it comes time to do your taxes, really sit and ask yourself: What purchases did I make this year that helped me run my business?

You can make this process easy by having Keeper automatically scan your purchases and create records for you!

Can you write off expenses if you get a 1099?

Absolutely. You don’t need an LLC to claim write-offs. And you definitely don’t need an S corp.

All self-employed people can claim business expenses on their taxes. That’s true if you’re a:

- ✓ 1099 contractor

- ✓ Freelancer

- ✓ Gig worker

- ✓ Small business owner

If you’re spending money buying something that helps you do your work, take the write-off.

You can bet giant corporations are writing off every expense they can think of. Why shouldn’t you?

Do you need receipts to claim a write-off?

Actually, no! A physical receipt is only required if you paid for a business expense in cash and spent more than $75 dollars.

To learn more about why, check out our deep dive into receipts for taxes.

What is the maximum deduction self-employed people can take?

Technically, there’s no upper limit to the business deductions you can take.

However, some types of expenses have their own upper limits. For instance, your home office deduction can’t be more than your income.

As an independent contractor, you have to take advantage of all the write-offs you qualify for. Otherwise, you're basically giving the IRS a free gift.

And if you want an app to automatically find and track all your expenses for you, click here to get started with Keeper.

.jpeg)