How do you measure a year? When it comes to doing your taxes, the answer to that question may depend on several factors, including whether you’re an individual taxpayer working for an employer or if you have a business.

A tax year is a 12-month calendar period that corresponds to your tax return. But that period might run from January 1 to December 31 or another window, depending on what kind of tax year you follow.

Read on to learn more pertinent information about tax years.

What is a tax year?

In the U.S. the tax year for individuals runs from January 1 to December 31. If you file your taxes yourself and don’t have an LLC, this is probably your tax year.

Tax returns in the U.S. for the year are due on April 15 of the following year. In other words, the tax return you send the IRS in 2025 covers the taxes withheld or owed for your earnings during the 2024 calendar year.

Types of tax years

If you file your taxes as an individual (as opposed to as a business entity), you’ll use the calendar year as your tax year.

After the calendar tax year ends on December 31, both you and the IRS will assess your income and expenses from the year and determine whether you’ll owe the IRS money, or receive a refund. Different factors — like your income, tax credits, or how much you’ve paid in taxes throughout the year through withholding or estimated tax payments — help determine your tax refund or how much you owe.

Although you may be mainly familiar with the calendar tax year, there are a couple other kinds to keep in mind: fiscal and short tax years.

{upsell_block}

Fiscal tax year

A fiscal tax year is any consecutive 12-month period that ends on the last day of any month except December. Typically only businesses use fiscal tax years. Any business can opt to use the calendar year as its tax year instead — and many smaller businesses do. Once a business adopts a tax year, calendar or fiscal, it must keep using that type of tax year unless it gets permission from the IRS to make a change.

Larger businesses that are classified as regular C corporations have more freedom to choose their tax years than other businesses, and often choose to use a fiscal year. For many C corps, the fiscal year ends in March, June, or September.

Bigger corporations typically choose to use fiscal years for accounting purposes. For example, a seasonal business or a business that does a lot of holiday sales can choose to use a fiscal tax year to avoid splitting a busy season into two different tax years.

If you’re a contractor with the federal government, you may choose a fiscal year that ends on September 30 — when the government’s fiscal year ends.

Using a fiscal tax year rather than the calendar year can make doing your taxes more complicated. If you choose a fiscal year, you have to file your tax return by the 15th day of the fourth month after the end of your fiscal year. For example, if your fiscal year ends on July 30, you have until November 15 to file.

Short tax year

As its name suggests, a short tax year lasts less than 12 months. A business might file a return for a short tax year if:

- The business started or stopped operating during that year

- The business changed its accounting period

- The business switched from a calendar to a fiscal year or vice versa.

You have to file a tax return for a short tax year. For example, if you start your business on April 1 and use the calendar year, you must file a return for April 1 through December 31. IRS Publication 538 can help you figure out your taxes for a short tax year.

What if you have a sole proprietorship, LLC, or partnership?

The IRS requires sole proprietors to use the calendar year. Single-member limited liability companies are typically taxed the same as sole proprietorships, so they also use the calendar year.

Partnerships, S corporations, and multi-member limited liability companies are all also required to use the calendar year as their tax years.

If your sole proprietor or single-member LLC grows and you become a partnership, corporation, or multi-member LLC, you’ll still have to use the calendar tax year unless you have permission from the IRS to use a fiscal year.

{email_capture}

Why do you pay taxes in April?

Taxes were a hot topic in early American history — the Boston Tea Party, a cornerstone of the lead-up to the Revolutionary War, was a protest of the British Parliament's tax on tea, with colonists fed up with paying taxes to a government they no longer wanted to answer to.

After declaring its independence, the United States passed and repealed tax laws for over a century. In 1913, the 16th Amendment was passed, granting the federal government taxation authority. At that point, only a small number of wealthy individuals were being taxed. As the country kept growing, it became necessary for the government to collect more taxes to support the needs of an expanding population.

Congress initially made March 1 tax filing day. Later, this date was moved to March 15, 1918, and then April 15, 1954. The IRS says it pushed back the tax deadline to give Americans more time to file, and more time for the agency to process everyone’s returns.

{write_off_block}

FAQ

When does the tax year start and end?

The calendar tax year starts on January 1 and ends on December 31. If you use a calendar year, you’ll file taxes for that year by April 15 of the following year, or the first business day after April 15, if April 15 falls on a weekend.

The fiscal tax year starts on the first day of one month and lasts for 12 consecutive months, ending on the last day of the 12th month. That month just won’t be December.

Is the tax deadline always April 15?

April 15 is the federal deadline for most taxpayers.

If you know you can’t finish your return on time, you can request a six-month extension using Form 4868 to move your filing deadline to October 15. Note that this extension moves the filing deadline but not the payment deadline, so if you owe taxes, those are still due by April 15.

State income tax deadlines are typically the same as the federal tax deadline, with some exceptions. Nine states don’t have state-level income tax. They are:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Washington

- Wyoming

If you file in Washington or New Hampshire and you have sizable investing income or capital gains income, you may still have tax filing obligations.

If you live in a county affected by a natural disaster, the IRS may extend your federal tax filing and payment due date. Be sure to check with your state’s revenue department if you have questions about your return’s due date.

There are civil and criminal penalties for not filing taxes. If you don’t file your taxes, you can lose your refund, face fines in interest and late fees, or even be taken to court by the IRS.

What tax year are we filing for in 2025?

In 2025, you will file your 2024 taxes. In other words, on April 15, 2025, you’ll file your taxes from January 1, 2024 to December 31, 2024. This is true every year: you pay taxes based on the previous calendar year (January to December), even though they’re due in April.

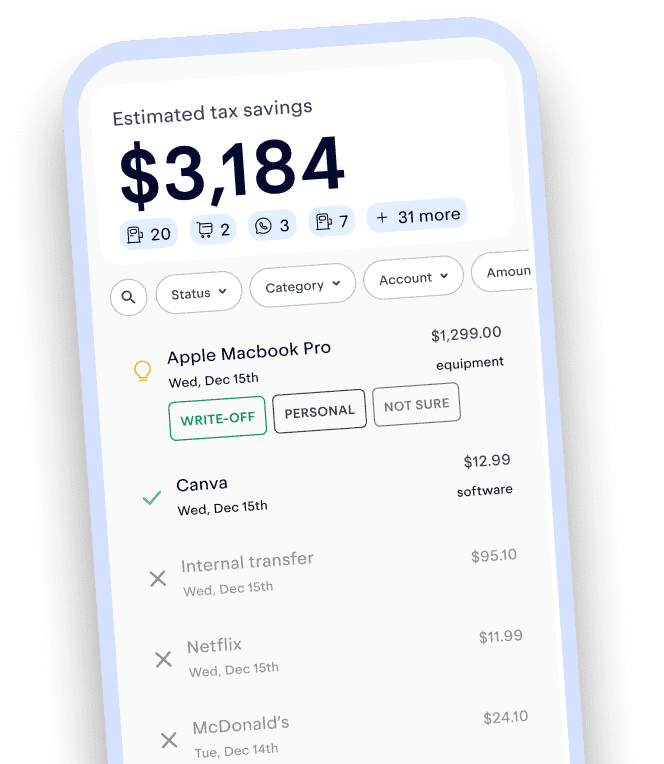

Regardless of which tax year you use to file your taxes, you’ll still need to file every year. Luckily, the Keeper app can help you keep track of your business income and expenses, so you can save as much as possible come tax time.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email support@keepertax.com with your questions.